Bigger baskets signal a revitalised FMCG market in UAE

The latest Fast-moving Consumer Goods (FMCG) sales data for the United Arab Emirates (UAE) indicate that individual shoppers spent more on groceries in Q3 of 2023 compared to the same period last year.

This marks a reversal from the degrowth observed until Q2. This performance was boosted by Ramadan and the back-to-school period. Sales value rose despite a lower frequency of visits, and a slight decrease in spend per trip. This indicates there has been an increase in purchase volume per trip – a very positive sign for brands and retailers within the market.

Consumers in the UAE are feeling more optimistic, against the backdrop of an upgraded annual growth projection driven by the resilient non-oil sector, which includes FMCG, real estate, tourism and financial services. This has offset the impact of the recent cut in the contribution made by oil to the nation’s GDP.

Inflation softens – with segment-specific nuances

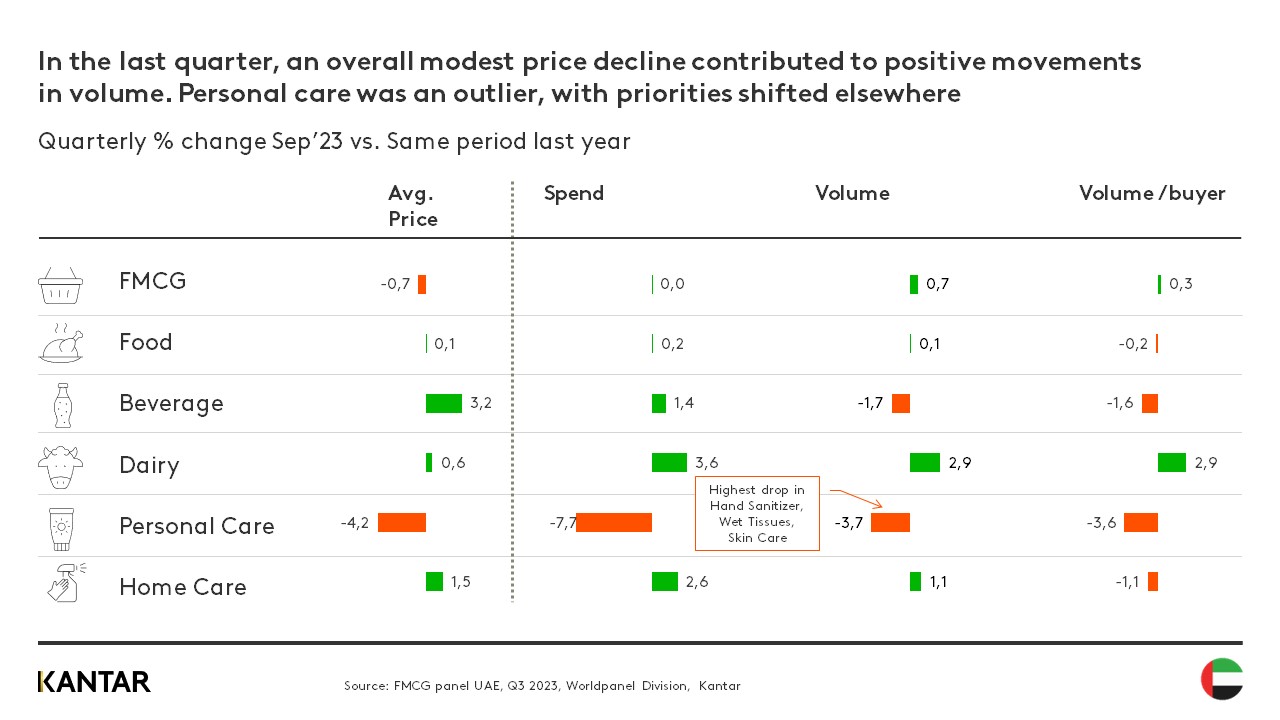

Overall, FMCG inflation in the UAE is on a downward trend, with price rises of 1.9% in Q2 followed by a modest drop of -0.7% in Q3. However, a segment-by-segment view reveals contrasting trends: for instance, prices are continuing to increase by 3.2% in the beverages category, while there is marked deflation of -4.2% in personal care.

Overall, we've seen minimal changes in consumer behaviour despite slight price fluctuations across most categories. As inflation begins to ease, shoppers are noticeably increasing the size of their baskets.

Personal care is the exception to the rule. This is where shoppers in the UAE have exhibited the most conspicuous cost-saving behaviour. Even though prices have dropped significantly, so has volume – by -3.7% – as consumers shifted their priorities to other sectors. Meanwhile, a 2.9% volume surge in the dairy category, in spite of a 0.6% price increase, suggests that it remains an essential purchase in consumers’ eyes.

These patterns underscore the nuanced effects of inflation on consumer spending, and implies that resilience and price sensitivity are segment-specific. Brands need to tailor their strategies to each individual category and its unique trends, to engage consumers, capture market opportunities and maintain volume growth.

Brands and retailers also need to understand how demographics influence shopping behaviour. With a 1.8% year-on-year volume growth in Q3, middle income consumers demonstrate strong growth potential, while targeting the higher socio-economic groups with upselling and cross-selling strategies will capitalise on their tendency to buy higher volumes per trip.

A need for innovation in promotional tactics

Brands’ promotional strategies are not currently resonating with consumers in the UAE. In times of inflation, one would expect shoppers to be more inclined towards deals. However, at 33% the percentage of purchases made under promotions in modern trade channels is disappointingly low, and remains stagnant.

This trend suggests that shoppers aren't perceiving enough added value in promotions as they are currently structured. Brands must rethink their approaches, innovating beyond simple price cuts to create personalised offers, enriched experiences, and value-centric campaigns, to align more closely with evolving consumer expectations and purchasing behaviours.

The UAE faces a number of key challenges moving into 2024, including higher interest rates for investments, and lower oil contribution to national GDP. In the dynamic FMCG landscape, brands must be ready to smartly align with market shifts, offering value-driven products, and segmenting strategically to build loyalty and leverage growth channels for a lasting competitive advantage.

Contact our experts to find out how to grow your brand in this context, and fill in the form at the right side of this page to download a deck with extra insights.

Get in touch

Charting UAE FMCG Landscape with Shopper Trends and Retailer PerformanceCharting UAE FMCG Landscape with Shopper Trends and Retailer Performance