Shopper Digest: Is All About Growing Your Shopper Base

Now, back to our topic for the day. Reflecting on the dynamics of the FMCG market in the year 2023, it was undeniably a challenging year, marked by challenges stemming from macroeconomic pressures and weak consumer sentiments. The surge in prices drove consumers, much like you and me, to continue reassessing and reevaluating our shopping habits and preferences.

It will be more difficult to obtain money and secure shoppers' purchases, especially when the demand is shrinking, on top of the more aggressive competition in the market. We have repeatedly shared with our clients that shoppers are spending cautiously, exhibiting less pantry-loading behavior, making more just-in-time purchases, and shifting their focus to buying only what is necessary and meaningful to them.

Principles of Growth

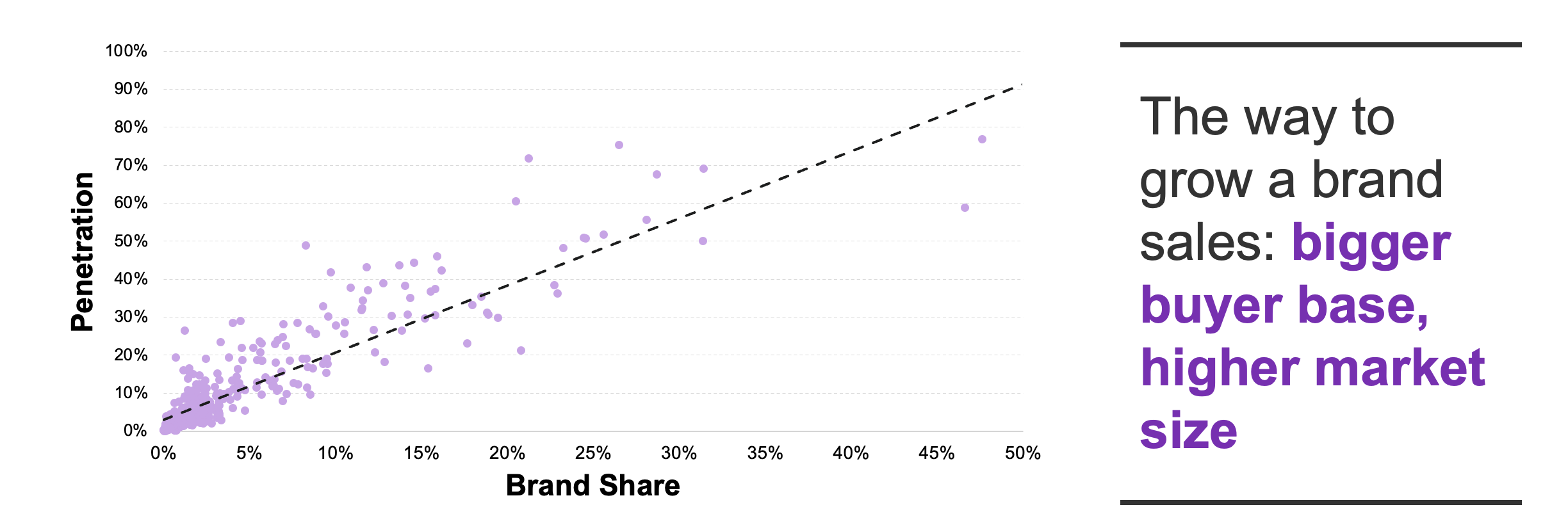

During our Shopper Excellence Summit 2022, we mentioned that Penetration is the core driver to grow market share within the category. As a matter of fact, according to our tracking, 88% of brands that experienced growth achieved it through increasing their Penetration.

When a brand starts to expand and build a larger buyer base, it naturally leads to an increase in loyalty to the brand. This stays true in the year 2023, and we believe it will be the same for 2024. This is one way to effectively grow your brand sales – by growing your buyer base, hence achieving a higher market share.

The Question is How?

There are many times when we only talk about winning shoppers from the competition (within the category). What if that is no longer the only challenge we must face? What if we tell you that brand competition will be more relevant if shoppers only choose to stay within the category?

In fact, our tracking reveals that shoppers could easily shift their purchasing behaviour (via different options), especially when pressured by inflation. About 60% of the categories had experienced a loss of shoppers (lower penetration) vs. 2 years ago – showcasing the risk of your category to remain relevant within the shoppers’ repertoire or consideration.

Would they continue to cut down even more categories? We may always generalise to say everyone "should" be cutting down, but the fact is we realise shoppers are recording different purchasing patterns – that’s where we need to monitor their buying behaviours depending on their point-of-view of the economy (and income) for the near future.

In short, finding the right strategy by engaging the right audience and leveraging the right message to drive the relevance for your category (and your brand) will be crucial moving forward.

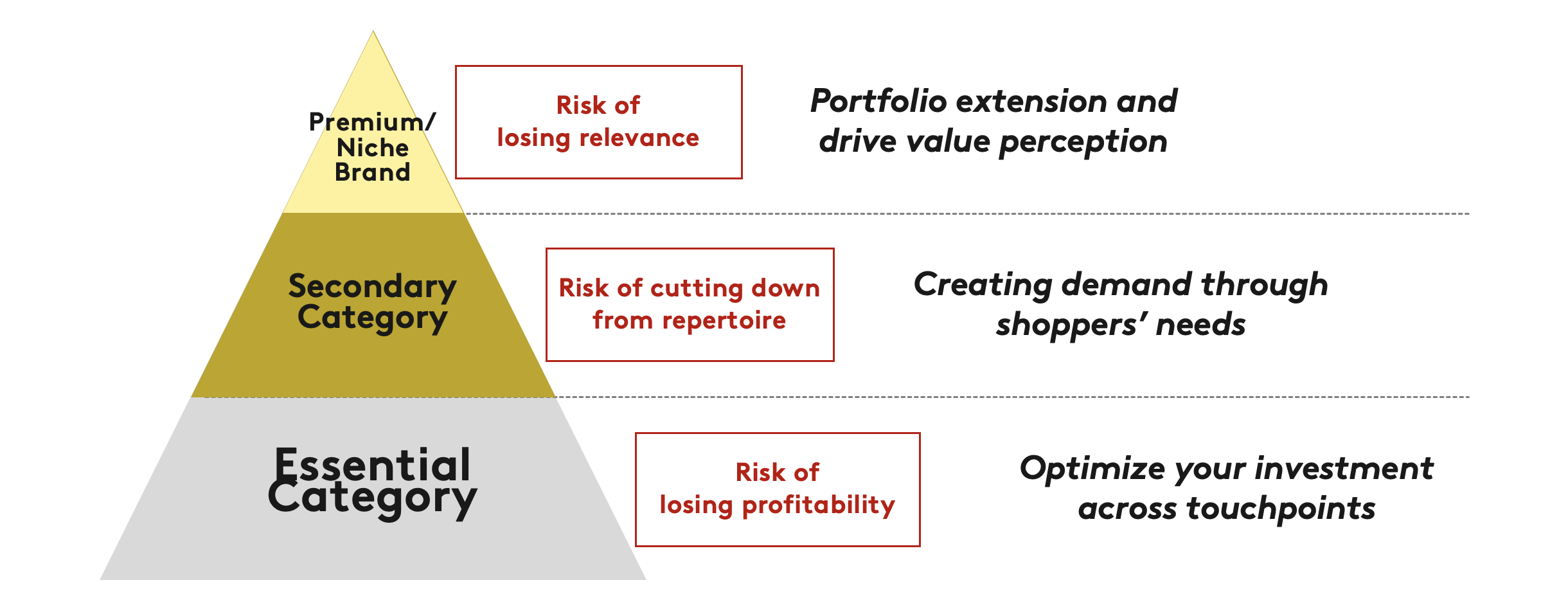

- If you are within the essential category – most probably you will face stiffer brand and promo competition as shoppers are looking out for more value from every single penny they pay. It is crucial to let your (potential) shoppers know either they could buy the same quality at a lesser price, or have a higher value perception of what they are getting with the same price they pay – the key is to optimise your investment across the different activation touchpoints.

- If you are in the secondary category (more likely to be cut down from the repertoire) – then you have to quickly identify the unique selling point that keeps shoppers to continue buying and using not just your brand, but the category. The competition is not just within the category itself, but also the pulling factors from the adjacent categories if you do not give shoppers a good reason to stay.

- If you are a premium/niche brand – a mass brand will always have a better advantage from the price point perspective. It is either you need to consider an extension of the portfolio catering to those who are planning to down-trade, or you have to create a more compelling reason for a very specific market that you are aiming for.

Penetration refers to the percentage of the population buying a specific brand over a period. It is a crucial measure that key industry players use to evaluate the size of their existing customer base (versus competitors) and gauge the opportunity for expansion. In the Worldpanel division, we guide our clients to grow their brands' sales by identifying growth opportunities in winning more buyers.

Source: P11’2023 Peninsular Malaysia Household Purchase - Kantar Malaysia, Worldpanel Division

Get in touch

Ang Jia Jian, JJ

New Business Development Manager - Kantar, Worldpanel Division Malaysia

- Send a messageAng Jia Jian, JJ