Rising prices drive FMCG spend in Africa & Middle East

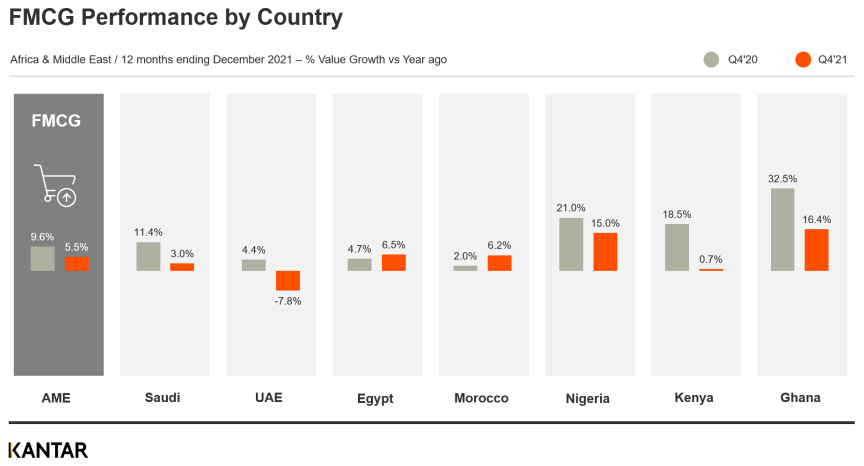

Take-home FMCG value in the Africa & Middle East (AME) region continued to grow in 2021, increasing by 5.5%, but at a slower rate than in 2020 when it rose 9.6%. This was as expected, with many countries returning to pre-pandemic norms after a bumper year driven by increased consumption and in-home occasions during times of lockdown and other restrictions.

Another big difference between 2021 and the previous year was that the growth in spend was largely driven by inflation, and an increase in grocery prices shoppers had to pay. FMCG volume sales were on the whole flat or in decline across many countries in AME, with purchasing starting return to pre-pandemic levels. Shopping frequency also dropped in all markets except for Egypt, Ghana and Kenya.

Spend grows across the region – with one exception

West Africa (Nigeria and Ghana) saw the fastest take-home FMCG value growth in 2021, due to inflation continuing to grow in double digits. This impacted grocery prices heavily. Inflation was highest in Nigeria, reaching 15%, which contributed to a 28.4% year-on-year price increase in the fourth quarter. Morocco was the most stable market, with inflation of 1.1% over the year, which was coupled with a healthy increase in GDP of 5.7%. The only market in which we witnessed a value decline was the UAE (-7.8%). This was driven by a population drop in the first half of the year, with the country largely dependent on expats (87% of households), many of whom left the country during the pandemic. We expect the population level to continue to pick up in 2022, with take-home FMCG spends rising in parallel.

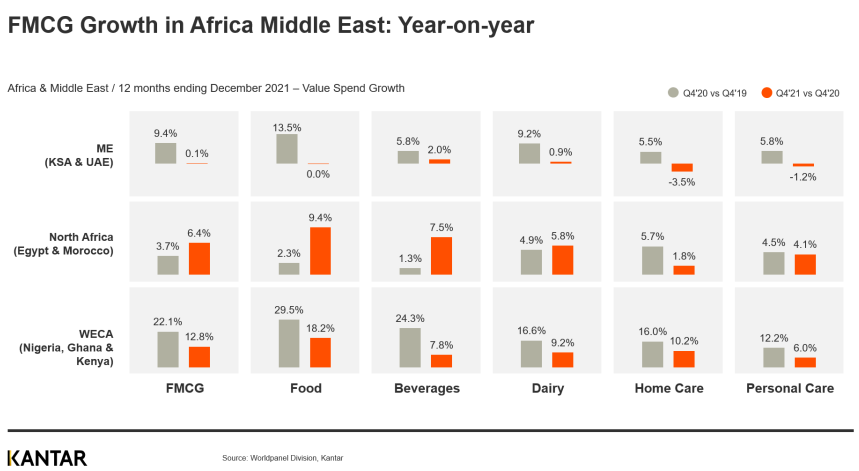

A gap between food and non-food

Looking at categories, the value performance of food and beverages was generally stronger than average, with growth of 8.3% and 5.5% respectively. Spend on non-food items grew much more slowly, with an increase of 2.9% in personal care and 2.4% in home care.

Overall, spend levels were impacted across all socio-economic classes in the AME region, highlighting that more affluent households were also hit by the pandemic and rising food prices, and are as willing to compromise on what they buy and what they pay as shoppers from lower classes.

These trends highlight how crucial it is for brands in AME to get price and promotion right in 2022, with inflation continuing to rise, high uncertainty across markets, and shoppers having to compromise on their purchasing decisions.

Download the deck with more insights through the button at the right side of your screen.

For more information on take-home FMCG performance in Africa & Middle East, or to request details of our price and promotion solution, please get in touch.