Consumers in MENA choose cheaper as inflation bites

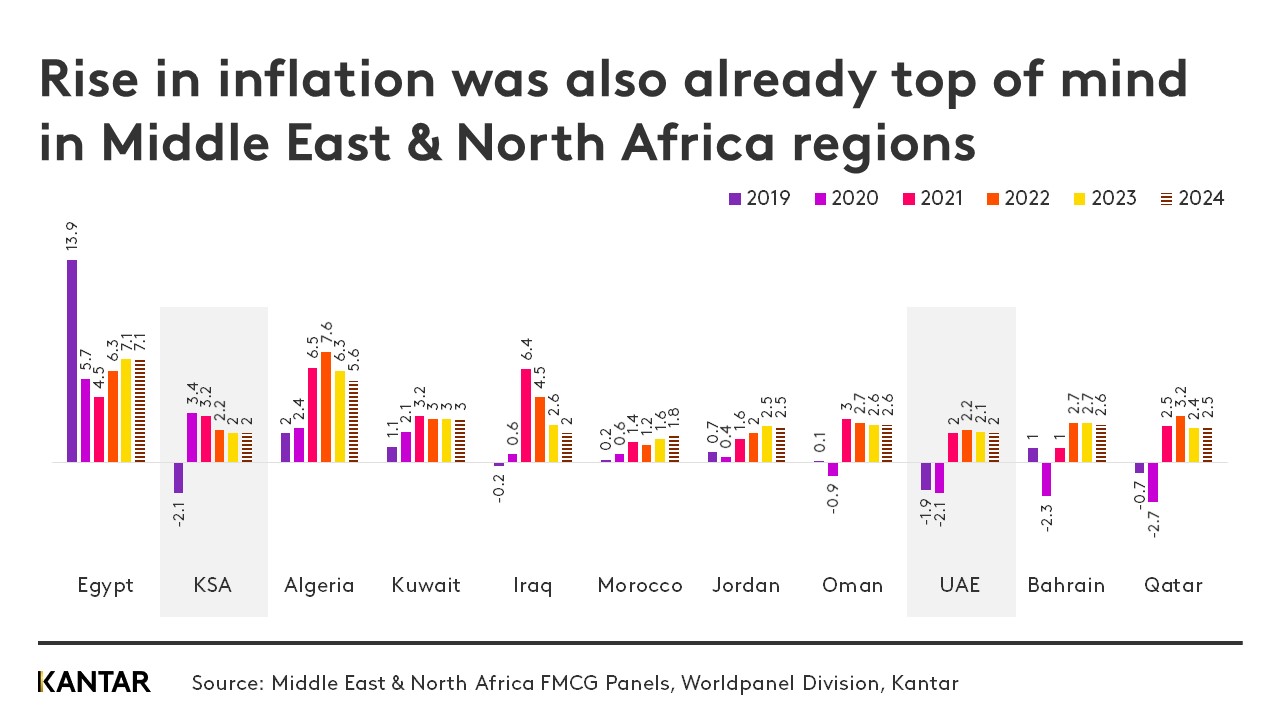

Global inflation is at its highest rate in years. This trend was already front of mind in the MENA (Middle East and North Africa) region, where prices had started to rise in early 2021, driven by soaring demand for goods as the economy rebounded, disruption in global supply chains and increasing energy prices. In Saudi Arabia for instance, housing and utility bills were impacted first, followed by food, due to a 10% surge in the cost of vegetables.

Price rises have also been compounded by other financial pressures hitting shoppers’ incomes, including lower salaries and new taxes, which influenced consumers to change their shopping habits.

Choosing cheaper

As pressure on household budgets intensifies, consumers in the MENA region are employing every possible rationalisation strategy to manage their FMCG spend. They have two main approaches: buy less, and pay less.

Buying less involves reducing the volume purchased of a product or category, buying it less often, or deciding to stop buying it altogether. Consumers seek to pay less by shopping in cheaper channels, switching to cheaper brands, and hunting for promotions.

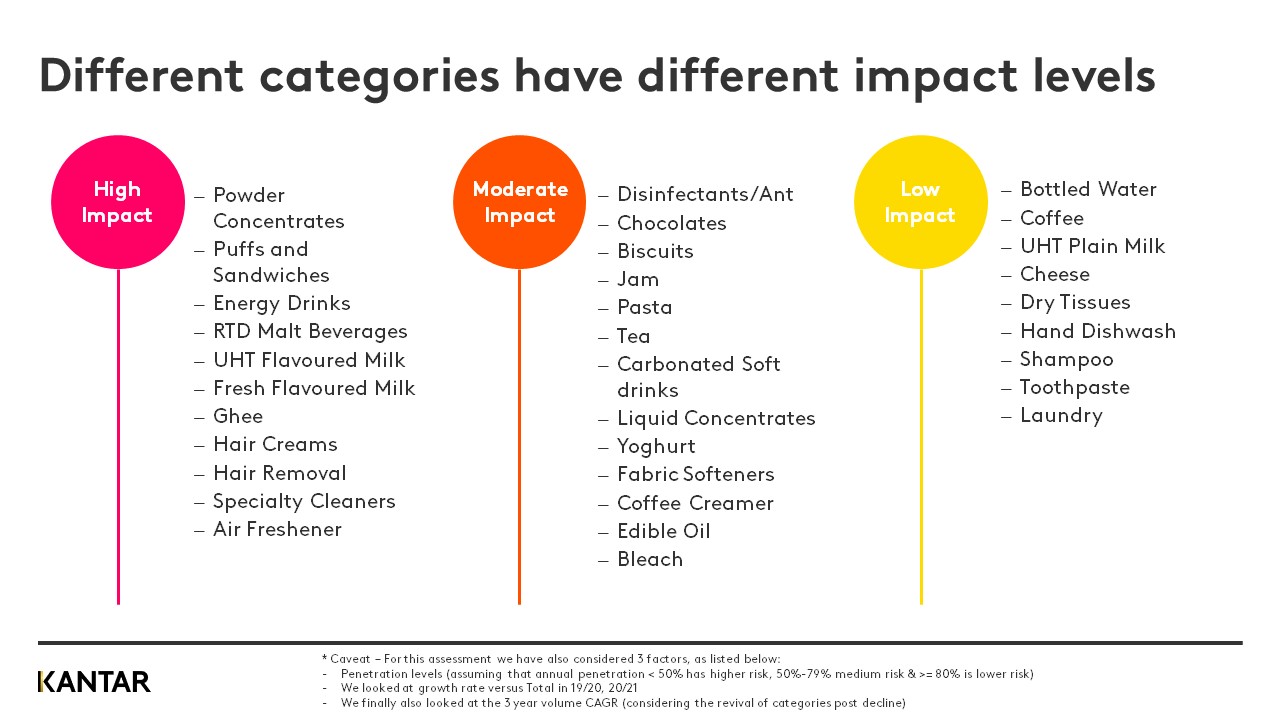

This behaviour change is affecting different categories to a different extent. Those that are feeling the impact most strongly are declining faster or growing more slowly than average, and shopping frequency has also dropped.

The moderately-impacted categories are products that shoppers can possibly do without. These may grow, but will lag behind the total growth seen across the FMCG sector. Impact will be lowest on the categories that are most essential, where spend will either grow or remain stable.

With price-sensitive shoppers rationalising categories, sectors, brands and channels, manufacturers need to meet their needs while preventing them from leaving the brand or the category altogether.

Give shoppers a reason to buy

Price wars are hard to win. As consumers consider switching to cheaper options, brands must instead offer significant differentiation to show why they’re worth spending the extra money.

Innovation is the most sustainable and profitable way of gaining new shoppers, retaining existing shoppers and growing share of spend in tough economic times – but it has to be big.

Incremental innovations don’t work, as they can be copied easily, while shoppers need a powerful reason to switch to a new product or add something to their repertoire. This means brands have to be bolder and more disruptive. The innovation must be also be meaningful: offering something that is highly relevant and improves people’s lives.

One brand that has achieved success through innovation in the MENA region is Careem. Originally developed as a ride-hailing app, it has expanded to become a one-stop shop that handles food and drink deliveries, bus rides and anything else that involves getting people and products from A to B. The business was acquired by Uber in early 2020.

Create advertising that resonates

Brands that are able to build higher equity with consumers excel during tough times. It may be tempting to cut ad spend right now, but this will be false economy. Return on ad spend has increased during the pandemic: Worldpanel data shows that for every $1 spent on advertising brands in the ME region saw a return of $2.80, compared with pre-pandemic levels of $1.80.

Manufacturers need to use advertising and marketing to highlight the value of their innovations, and how they will benefit shoppers’ lives in the post-pandemic world.

Re-evaluate the promotions strategy

Promotions have been growing consistently across the MENA region over the last few years, and shoppers will continue to seek money-saving deals. However, it’s possible that governments will either put a cap on promotion levels or advise against excessive promotional activity to prevent bulk buying that leads to empty shelves.

Manufacturers need to work out which promotions provide the best value to the shopper, as well as determine how far they can increase their activity without eroding profitability.

Think about pack size

A number of premium, non-essential categories have benefited from offering smaller packs to keep shoppers within the category, allowing them to continue to enjoy a product while spending less. After the sugar tax was introduced, Coca-Cola found success in the MENA region through offering a smaller pack size – both smaller cans, and smaller bundles – giving shoppers a cheaper option while keeping hold of them.

Brands could also benefit from launching economy versions to prevent shoppers switching to cheaper competitors. Larger packs or bundles are gaining relevance, too, even in fresh categories such as fresh milk and sliced bread.

In Kenya, P&G has covered all bases by launching Downy in a 20ml sachet as well as larger 500ml and 1L packs, to suit all needs, make the product accessible to everyone, and encourage trial.

Drive availability

As shoppers visit stores less often, brands need to be present in the growing channels depending on their category. Modern trade has become MENA shoppers’ favoured option for saving money, and traffic is expected to continue to grow. However, brands shouldn’t limit themselves to modern trade stores; top-up missions are unlikely to go away, making smaller convenience formats relevant.

Discounters are likely to increase in popularity, with their fixed price points and heavy discounts appealing to cost-conscious shoppers.

Another way brands can stand out is to focus on delivering a fantastic in-store experience. Investing in point of sale (POS) and multiple touchpoints will all make a brand more memorable.

Target new and evolving occasions

Tapping into in-home occasions during Covid drove success for many brands. Baking mixes brand Betty Crocker successfully leveraged the growth of in-home snacking occasions in Saudi Arabia through a famous campaign – Kitchen for everyone – which aimed to get all family members involved in baking, having fun, and making memories. As a result it moved into the country’s Top 30 most valuable brands, and achieved 62.5% penetration.

Price rises are set to rise further in the MENA region as a result of the Russia-Ukraine war. Shoppers from all buyer groups will continue to look for ways to manage their budgets, with volume expected to reduce while spend increases. They will also shop less often, but buy more per trip. Inevitably, many will make tough decisions about what they can afford to keep in their baskets – cutting some products and categories out altogether. Manufacturers must provide a compelling reason to buy, while understanding and addressing any barriers to purchase.

If you’d like to discuss these findings, do not hesitate to contact our experts. To find out more, download the paper through the link at the right side of this page.

Get in touch

Get in touch

Chloe Robinson

- Send a messageChloe Robinson

Inflation goes up in Middle EastInflation goes up in Middle East